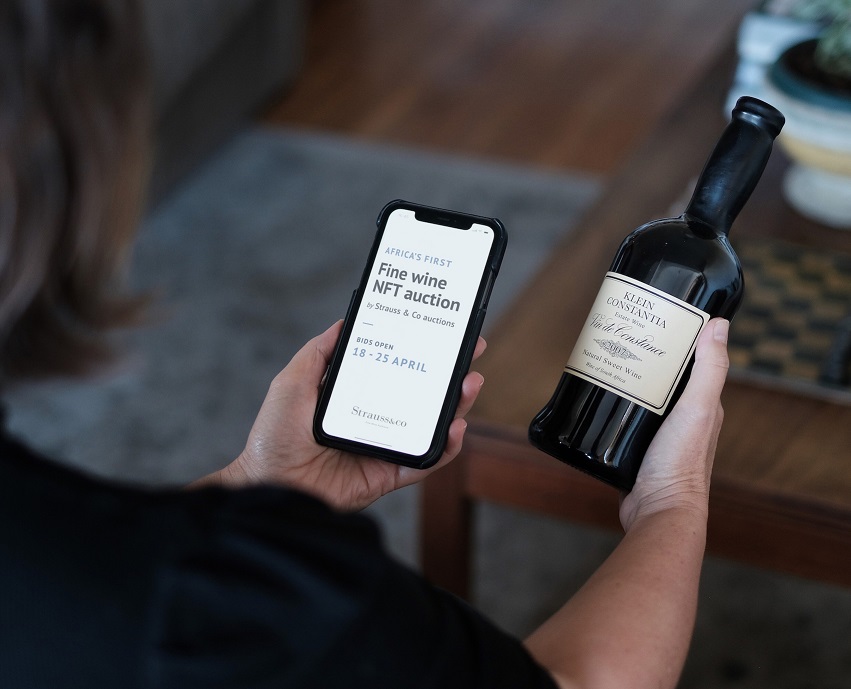

Principal South African auction house Strauss & Co has partnered with five of SA’s most respected fine wine producers to offer Africa’s first fine wine Non-Fungible Tokens (NFT) on auction from 18 – 25 April. Capturing past, present and future vintages, these unique digital contracts encompass vertical collections of Klein Constantia Vin de Constance, Kanonkop Paul Sauer, Meerlust Rubicon, Mullineux Olerasay and Vilafonté Series C. Each NFT holds between 20 and 50 vintages, with collections from 66 to 288 bottles. Strauss & Co Fine Wine Auctions is a joint venture between leading fine wine merchant WineCellar.co.za, sommelier Higgo Jacobs and leading auction house, Strauss & Co.

“We are beyond excited to be launching Africa’s first NFT auction online which we believe can play an important part in generating awareness for South African fine wine internationally,” said Roland Peens WineCellar.co.za Director and Strauss & Co Fine Wine Specialist. “Various fine wine NFTs have become available over the last 2 years as the NFT market has boomed. Strauss & Co Fine Wine NFTs, however, offer a unique iconic South African industry collective of verticals direct from the producers, providing unprecedented ownership of vintage wines and futures to the collector and investor.”

Non-fungible tokens are a highly efficient way to package a collection of wines for trading and investment. The digital contract, stored on the polygon blockchain, includes all the provenance, pricing, transaction, sensorial and aging information. This importantly authenticates the bottles within the NFT since all the wines were selected from the estate’s library stocks, corresponding to each bottle’s seal-code. The transactions are extremely cheap and fast, and don’t add any marginal energy cost.

Each bottle within the NFT is also minted as an NFT, allowing for drinking or trading of single bottles at any time. Strauss & Co will coordinate the NFT through to maturity, making sure each vintage is added, as well as ‘burning’ NFTs when stock is withdrawn. This likely constitutes the first fine South African wines to be transacted on the blockchain.

Web3 development partner, Fanfire, have partnered with Strauss & Co to curate and transact the fine wine NFTs. Fanfire director, Gert-Jan van Rooyen is Associate Professor Extraordinary for the Internet of things at Stellenbosch University, and took overall responsibility for the security, payment and technical parameters of the NFT and blockchain transaction.

Once auctioned, the NFTs can be traded by the owner on any platform, radically increasing its liquidity and target market across the world. The NFTs include perfect cellaring of the wines until maturity, while the contracts are held in a custodial wallet or sent to a cold wallet such as the Venox Vault (https://venox.io/).

Many of the wines within the NFT are extremely rare. Only a handful of the 1980 Rubicon and 1986 Vin de Constance are owned by the estates and complete verticals likely don’t exist outside the estates. Maiden vintages of Vilafonté Series C are impossible to find, Mullineux Olerasay is produced in miniscule quantities and icon vintages of Kanonkop Paul Sauer 2009 and 2003 are now also very rare.

While South Africa has produced wines for over 350 years, the historic wine estates such as Meerlust, Klein Constantia and Kanonkop have only been producing bottled wines for four to five decades. These three historic producers have reached a new level of quality within the last decade however, while new producers such as Vilafonté and Mullineux Family have driven this fine wine boom.

As well as offering the world’s greatest wines, Strauss & Co have assisted in developing the secondary market for vintage South African wines. Providing collectors and investors the platform, the top SA wines have shown high appreciation on the secondary market. A single bottle of 1821 Grand Constance sold for R967,300 (c. £50,000) in 2021 while nineteen jeroboams across 3 decades of Kanonkop Paul Sauer (1986-2006) sold for R546,240 (c. £28,400) in 2020.

More recent vintages such as Vilafonté Series C 2009 average R4,805 (c. £250) per bottle on Strauss & Co, which is a 25% annualised price growth over the last decade. Meerlust Rubicon 2009 has on average grown 17% per year, while the Neal Martin 100-point Mullineux Olerasay No 2 has sold at a premium of 227% since the 2020 release.

What about the charity component?

NFTs make the payment to charities very simple, with the ability to write payment rules into the NFT contract on the first sale and post trades. A percentage of the NFT proceeds will be paid to Sp(i)eel, along with other charities. Sp(i)eel is a ground-breaking NPO that uses arts in wineland communities to address inequality and intergenerational trauma and to assist in the development of psychosocial well-being.

How are the reserve prices set?

Each NFT contains a different range of past and future wines, varying quantities and bottle sizes, all further adding to the non-fungible nature of the collections. Reserve prices of each NFT are based on historical Strauss sales, with future vintages set at current prices.

How do I bid?

Strauss & Co holds regular virtual live and online auctions on their industry-leading platform. The five lot NFT sale will take place online from 18-25 April on Straussart.co.za. Bidders can make payment in ZAR as well Bitcoin and Ethereum. There is a standard KYC process for fiat and cryptocurrency purchases.

BID ON THE AUCTION

Viewing of lots opens 11-18 April, with bids open from 18 – 25 April

View lots & bid online: https://www.straussart.co.za/

@strauss_and_co

#NFTauction #NFTwine

PARTICIPATE IN THE WEBINAR

NFT x FINE WINE

Africa’s first NFT fine wine action by Strauss & Co auctions

13 April 3pm

https://youtu.be/JoLrFpG25xA

Provided