Dell Technologies (NYSE: DELL) announces financial results for its fiscal 2024 third quarter. Revenue was $22.3 billion, down 10% year-over-year. The company generated operating income of $1.5 billion and non-GAAP operating income of $2 billion, down 16% and 17% year-over-year, respectively. Diluted earnings per share was $1.36, and non-GAAP diluted earnings per share was $1.88. Cash flow from operations for the third quarter was $2.2 billion, driven by profitability and strong working capital performance. The company has generated $9.9 billion of cash flow from operations throughout the last 12 months.

Dell ended the quarter with remaining performance obligations of $39 billion, recurring revenue of $5.6 billion, up 4% year-over-year, and deferred revenue of $29.1 billion, up 7% year-over-year, primarily due to increases in software and hardware maintenance agreements. The company’s cash and investment balance was $9.9 billion.

“We have proven our ability to generate strong cash flow through profitability and working capital efficiency, including $9.9 billion of cash flow from operations over the last twelve months,” said Yvonne McGill, chief financial officer, Dell Technologies. “Our long-term financial framework and capital allocation plan continue to deliver results, with $1 billion returned to shareholders in the third quarter through share repurchases and dividends.”

Infrastructure Solutions Group delivered third quarter revenue of $8.5 billion, flat sequentially and down 12% year-over-year. Servers and networking revenue was $4.7 billion, with 9% sequential growth driven by AI-optimized servers. Storage revenue was $3.8 billion, down 8% sequentially with demand strength in unstructured data solutions and data protection. Operating income was $1.1 billion.

Client Solutions Group delivered third quarter revenue of $12.3 billion, down 11% year-over-year and 5% sequentially. Commercial client revenue was $9.8 billion, and Consumer revenue was $2.4 billion. Operating income was $925 million.

“Technology is everywhere, and we continue to focus on extending our leadership positions and turning new opportunities into incremental growth,” said Jeff Clarke, vice chairman and chief operating officer. “Our servers and networking business was up 9% sequentially fueled by customer interest in generative AI. And heading into FY25, we expect revenue growth given the tailwinds to our business.”

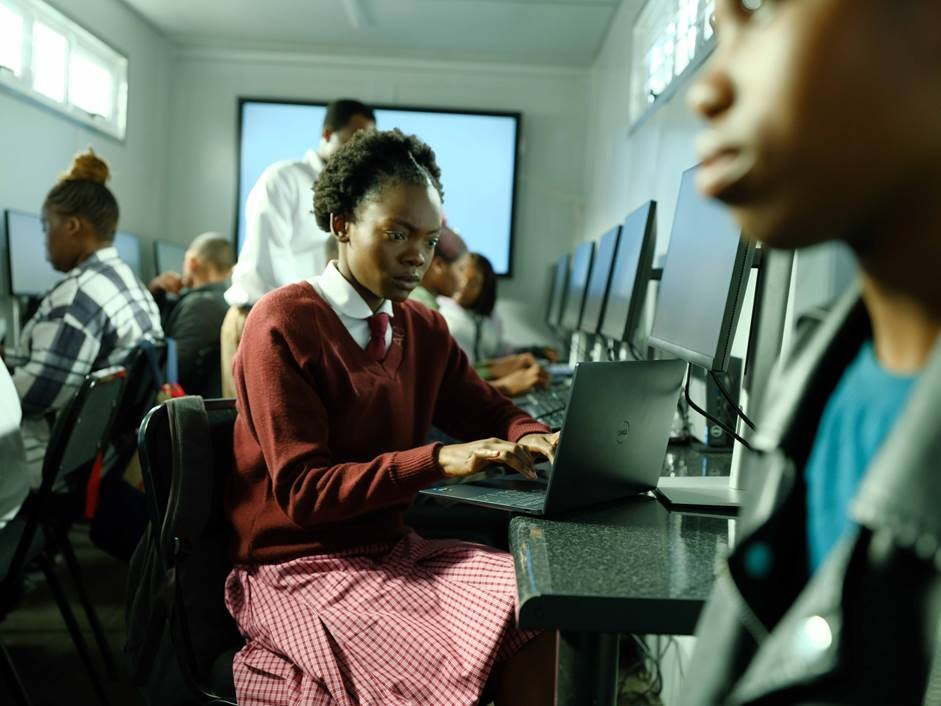

Dell continued to expand its broad portfolio to help customers meet their performance, cost and security requirements across clouds, on premises and at the edge.

- The Dell Generative AI Solutions portfolio expanded with new on-premises offerings that make GenAI implementations simpler with high-performing IT infrastructure, multicloud access and professional services.

- ObjectScale XF960 is an all-flash, scale-out appliance for GenAI and real-time analytics based on Dell’s software-defined object storage software, which can run on Linux and Red Hat Open Shift on PowerEdge servers.

- Dell’s collaboration with Meta makes it easy for customers to deploy Meta’s Llama 2 models on premises with Dell’s GenAI portfolio of IT infrastructure, client devices and professional services.

- Dell’s collaboration with Hugging Face helps enterprises create, fine-tune and implement their own open-source GenAI models with the Hugging Face community on Dell infrastructure products and services.

- Dell APEX Cloud Platform for Microsoft Azure simplifies the hybrid cloud experience by helping customers extend Azure to data center and edge locations.

- Dell APEX Cloud Platform for Red Hat OpenShift, the first fully integrated application delivery platform purpose-built for Red Hat OpenShift, helps customers deploy, manage and run containers alongside virtual machines on premises.

- The Precision 7875 Tower is Dell’s most scalable and powerful AMD processor-based workstation and lets companies develop and fine-tune complex GenAI models locally before deploying them at scale.

Conference call information

As previously announced, the company will hold a conference call to discuss its performance and financial guidance on Nov. 30 at 3:30 p.m. CST. Prior to the start of the conference call, prepared remarks and a presentation containing additional financial and operating information prior to financial guidance may be downloaded from investors.delltechnologies.com. The conference call will be broadcast live over the internet and can be accessed at https://investors.delltechnologies.com/news-events/upcoming-events

For those unable to listen to the live broadcast, the final remarks and presentation with financial guidance will be available following the broadcast, and an archived version will be available at the same location for one year.

Article Provided